AI‑Powered Investment & Document Intelligence - Built for Trust

Actaware turns millions of unstructured pages of PDF reports, filings, policies, and news into decision-grade insights so investment managers and organizations can move faster, operate and invest smarter, and stay ahead of the curve.

With Actaware, navigating today’s complex financial data and ESG landscape becomes intuitive supported by transparency, traceability, and actionable insight.

Our Capabilities

Actaware provides a comprehensive suite of tools and capabilities designed to help organizations navigate the complex landscape of data, ESG data and sustainability reporting. Our platform combines cutting-edge technology with deep domain expertise to deliver actionable insights that drive better decision-making.

The Problem: Why managers struggle with today’s data?

Key challenges that hinder efficient data utilization and decision-making:

Unstructured Overload

Key metrics live in thousands of PDFs, filings, policies, earnings calls, and news.

Rigid Vendor Solutions

Off-the-shelf scores don’t reflect your investment strategy.

Opaque Methodologies

Lack of traceability creates risk and weakens conviction.

Manual & Expensive

Analyst teams are stuck parsing noise instead of finding signal.

Actaware’s solution transforms

complexity into clarity at scale:

AI-Powered Structuring

We extract, normalize, and deliver metrics from any company disclosure or news source.

Custom Analytics

Tailored signals aligned to your portfolio, themes, and mandate.

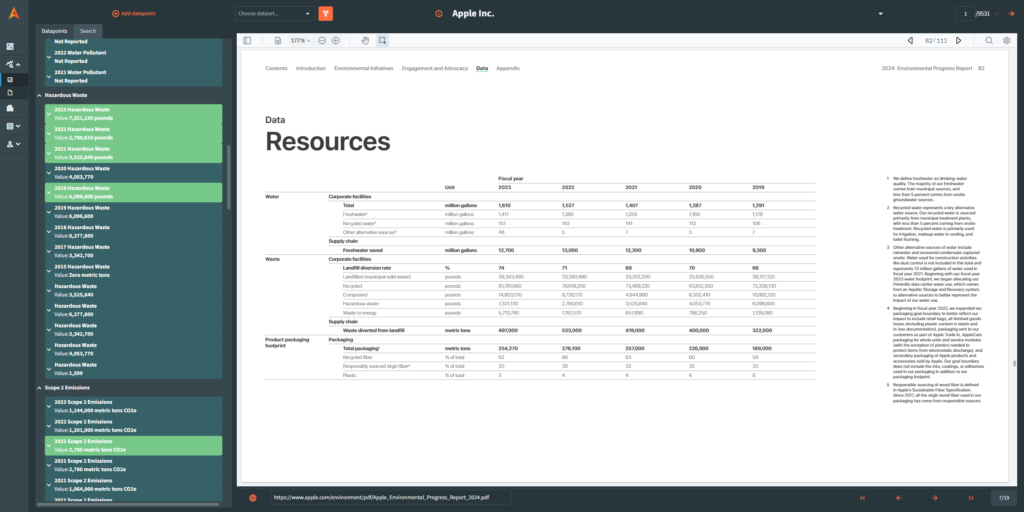

Audit-Ready Traceability

Every data point is linked to the original source — no black box, no guesswork.

Cross-Framework Compliance

ESG Metrics are aligned with CSRD, SFDR, TCFD and evolving standards.

Tested and Human-Verified AI

Built for Asset Managers and Organizations to Convert Unstructured Documents into Accurate, Decision-Ready Intelligence.

10K+ Companies

Collecting documents on over ten thousand companies

200+ Metrics

Extracting defined metrics

800K+ Sources

Tracking and analysis of diversified data sources

3.4M+ Datapoints

Identifying datapoints driving growth and value creation

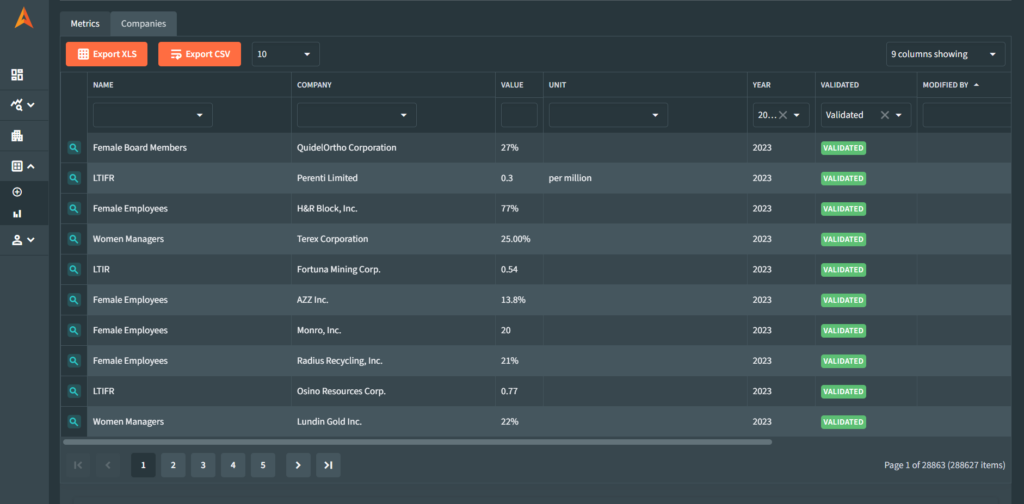

ESG Metrics Dashboard

Track, report, and optimize performance across critical ESG dimensions:

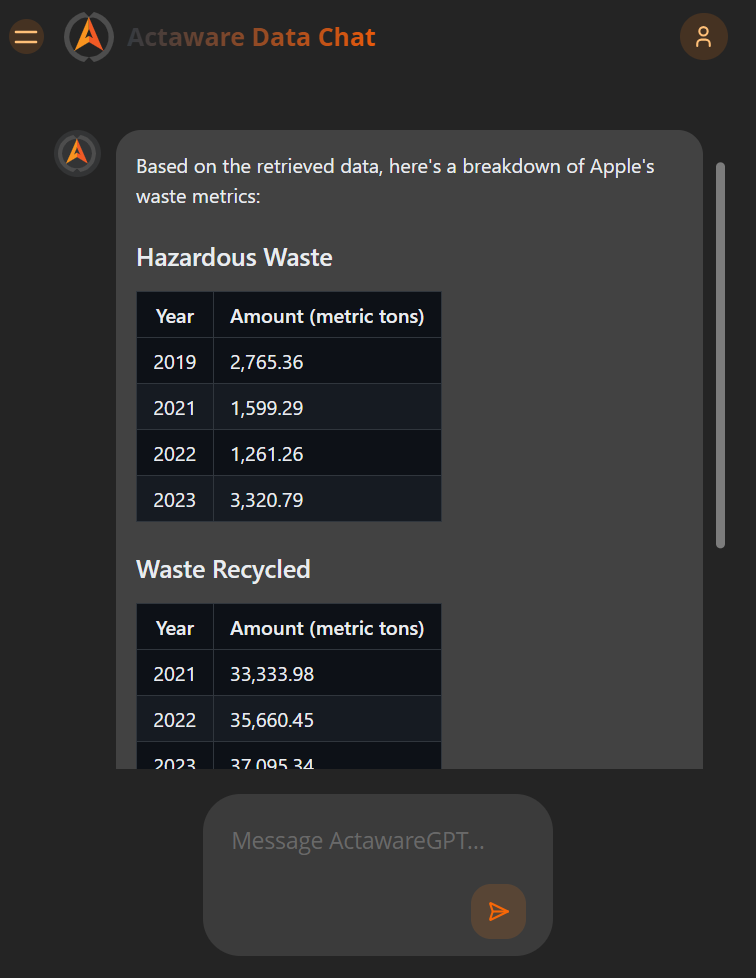

Environmental Metrics

- Waste Management Metrics

- Water Management

- Energy Management

- Greenhouse Gas Emissions (GHG) – Scope 1, 2 & 3

Social Metrics

- Workplace Safety Indicators

- Diversity Metrics

- Representation in Leadership & Workforce

Framework Alignment

All metrics are structured for alignment with leading frameworks such as GRI, SASB, CSRD, and TCFD.

Advanced Data Capabilities

Uncover hidden risks, opportunities, and strategic pathways through our deep data layers:

Easily compare internal policies against regional requirements and global best practices.

Customized insights tailored to the unique ESG profile of key sectors.

Understand business performance through granular revenue stream decomposition.

Identify and map manufacturing or operational sites to assess:

- Tariff implications

- Risk exposure

- Environmental footprint

Policy Intelligence Engine

Comprehensive Policy Analysis

We centralize and analyze a wide array of corporate ESG policies to help you assess compliance, alignment, and risks:

- Modern Slavery Policies & Statements

- Human Rights Policies & Statements

- Environmental, Biodiversity & Deforestation Policies

- Climate Change Policies

- Environmental, Health & Safety Policies

- Anti-Bribery & Corruption Policies

- Whistleblower Protection Frameworks

- Diversity, Equity, and Inclusion (DEI) Policies

- Parental Leave and Workplace Wellness Policies

Always Up-to-Date Repository

Access a comprehensive, always up-to-date repository of policy documents enriched with metadata for contextual relevance, cross-industry benchmarking, and compliance insight.

End-to-End Data Lineage & Traceability

Build trust with auditable data. Our platform ensures:

- Complete information transparency

- Full data lineage from source to insight

- Robust traceability for every metric, document, and decision

AI-Powered Research Tools

Meet your knowledge partner:

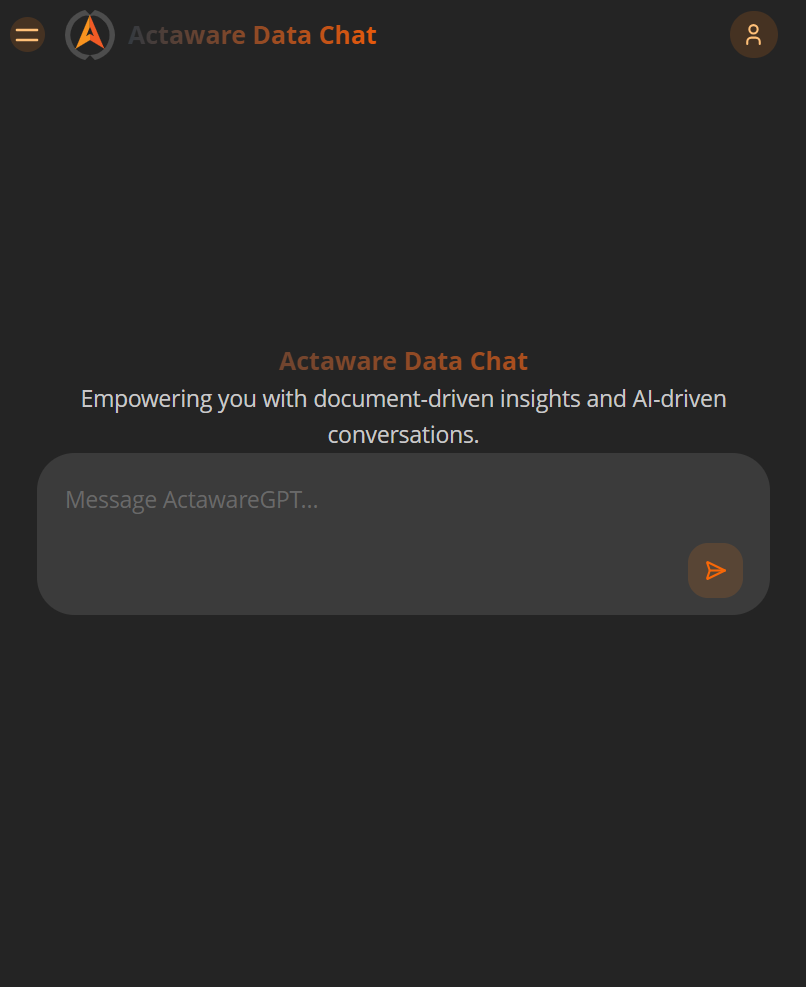

Chatbot Assistant

Ask complex queries and get instant, context-aware answers powered by curated, high-quality data.

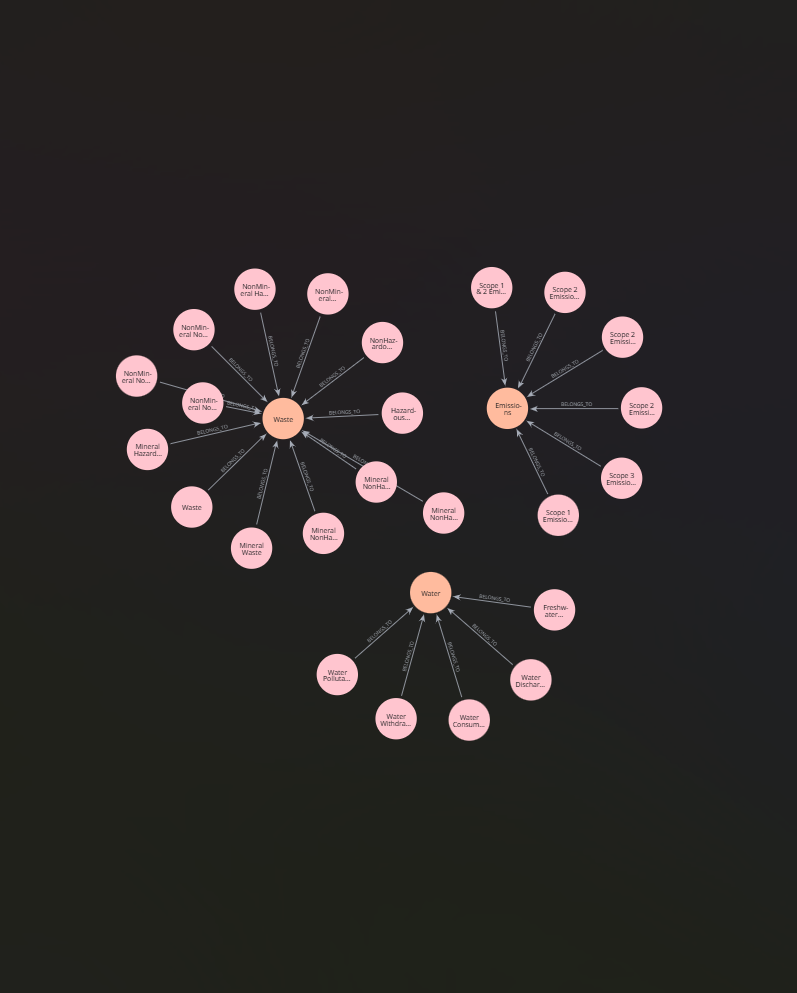

Knowledge Graphs

Visualize interconnected risks, policies, metrics, and actors—unlocking new dimensions in decision-making.

ESG Databases

Maintain a structured ESG data lake integrated with global filings and verified reports.

Why Choose Actaware?

Future-Proof Your Strategy

In today’s rapidly evolving regulatory landscape, organizations need partners who can help them not just comply with current requirements, but anticipate future changes. Actaware’s forward-looking approach ensures you’re always prepared for what’s next in sustainability reporting and ESG performance.

Contact Us Today

Let us help you turn compliance and risk management into competitive advantage. Schedule a demo or speak with our experts today.

Contact us at inquiries@actaware.com